In the exhilarating, often turbulent, world of cryptocurrency, the pursuit of efficient and profitable mining is a never-ending quest. Bitcoin, Ethereum, Dogecoin – each digital asset presents unique challenges and opportunities. Amidst this dynamic landscape, the choice of mining hardware is paramount. This is where Canaan, a leading manufacturer of ASIC mining machines, enters the frame, offering solutions designed to deliver both performance and value.

The core of Canaan’s appeal lies in its dedication to producing application-specific integrated circuits (ASICs) tailored for specific mining algorithms. Unlike general-purpose computers that can be adapted for various tasks, ASICs are laser-focused on a single objective: maximizing hash rate while minimizing energy consumption. This efficiency translates directly into higher profitability for miners, especially in a competitive market where electricity costs can significantly impact returns.

The allure of cryptocurrency mining, particularly for Bitcoin (BTC), stems from its potential for generating passive income. But the reality is far more complex. Successful mining necessitates careful consideration of numerous factors, including hardware costs, electricity rates, cooling solutions, and the ever-fluctuating difficulty of the blockchain network. It’s not a simple equation; it’s a multifaceted challenge demanding strategic planning and optimized resource allocation.

One of the critical advantages of choosing Canaan machines is their robust build quality and reliability. In the demanding environment of a mining operation, where machines operate continuously, often under considerable thermal stress, durability is key. Canaan’s reputation for producing dependable hardware translates into reduced downtime and lower maintenance costs, further enhancing the overall cost-effectiveness of the investment.

But the initial investment in mining hardware is only one piece of the puzzle. Mining farms, sprawling data centers dedicated to cryptocurrency mining, represent a significant commitment. The infrastructure required to house and operate these machines – including cooling systems, power distribution units, and network connectivity – can be substantial. Mining machine hosting services offer an alternative, allowing miners to leverage the infrastructure of established facilities, thereby reducing upfront capital expenditure and operational complexity. This option is particularly attractive for individual miners or those with limited technical expertise.

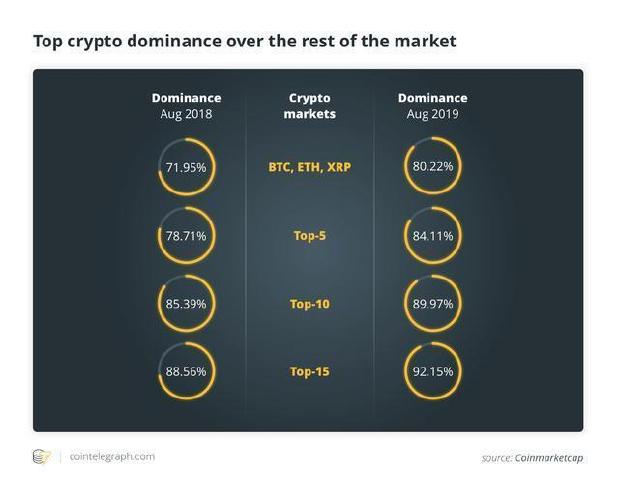

The profitability of mining also hinges on the choice of cryptocurrency to mine. While Bitcoin remains the dominant player, other cryptocurrencies, such as Ethereum (ETH) and Dogecoin (DOGE), offer potentially lucrative opportunities, depending on market conditions and network difficulty. The selection of the appropriate ASIC miner is crucial, as each cryptocurrency employs a specific mining algorithm. Canaan offers a range of machines designed for different algorithms, providing miners with the flexibility to adapt to changing market dynamics.

Beyond the technical aspects, the legal and regulatory environment surrounding cryptocurrency mining is also evolving. Governments worldwide are grappling with the challenges of regulating this nascent industry, and the implications for miners can be significant. Staying abreast of regulatory developments and ensuring compliance is essential for long-term sustainability.

The fluctuating value of cryptocurrencies adds another layer of complexity to the equation. Bitcoin’s price volatility, for instance, can dramatically impact the profitability of mining operations. Miners must carefully manage their risk exposure and consider strategies such as hedging or diversifying their cryptocurrency holdings to mitigate potential losses. Furthermore, the rise of Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs) introduces new avenues for generating revenue within the crypto ecosystem, demanding continuous learning and adaptation.

Ultimately, the decision to invest in Canaan mining machines, or any mining hardware for that matter, requires a thorough cost-benefit analysis. Miners must carefully evaluate their electricity costs, hardware costs, and the projected revenue from mining. They must also consider the long-term prospects of the chosen cryptocurrency and the overall health of the cryptocurrency market. In the end, the pursuit of cost-effective mining is a balancing act, requiring a blend of technical expertise, financial acumen, and a willingness to embrace the ever-changing landscape of the digital frontier.

Canaan miners: reliable ROI. Beyond initial price, efficient hash rates and power consumption deliver long-term profitability. A smart choice for serious miners seeking cost-effective gains.