**Ever wondered why some crypto miners bank massive profits while others barely break even?** The secret often lies in *strategic mining profitability forecasting*—more than just luck or raw hashing power. With Bitcoin slashing block rewards and Ethereum pivoting to proof-of-stake, navigating this terrain is like riding a roller coaster blindfolded unless armed with razor-sharp insights.

The Landscape of Mining Profitability: A Numbers Game with a Twist

Mining isn’t just about firing up rigs and hoping for the best anymore. As of 2025, the Cambridge Centre for Alternative Finance reports a seismic shift: energy costs now dictate over 60% of profit margins for mainstream Bitcoin (BTC) miners, eclipsing hardware efficiency. This makes *forecasting electricity prices* and *network difficulty trends* more pivotal than ever.

Consider the case of a mid-sized Bitcoin mining farm in Nevada that capitalized on low off-peak electricity tariffs combined with dynamic difficulty drops during network adjustments in Q1 2025. This tweak in operational timing translated into a 20% boost in net margins within just three months—a textbook example of leveraging data-driven mining strategies.

Rethinking Miner Deployment: The Edge of Hosting and Cloud Mining

Deploying physical mining rigs (the trusty workhorses of crypto mining) is no longer the one-hit wonder for newcomers. With volatile hardware supply chains and soaring upfront CapEx, experienced miners increasingly embrace hosting services or cloud mining platforms that promise operational agility and risk mitigation.

Take Ethereum (ETH) mining pre-Merge as a benchmark—miners utilizing hosted rigs in cooler climates not only slashed cooling costs by ~25%, but also gained access to geographically diversified hash power, cushioning against local network disruptions. Such adaptability fosters sustained revenue streams, juxtaposing with traditional solo mining’s all-eggs-in-one-basket gamble.

Algorithms, Altcoins, and Opportunistic Shifts

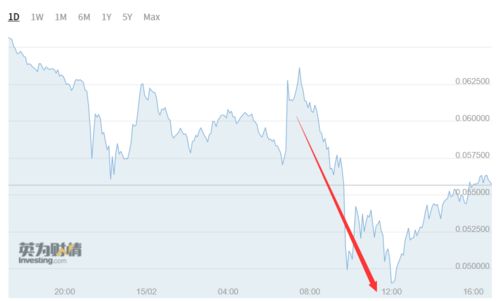

Mining profitability forecasts must consider the *mercurial nature* of altcoin ecosystems like Dogecoin (DOG). Unlike Bitcoin’s halving cycles, DOG’s inflationary model intertwines with viral market sentiment and community-driven incentives. Savvy miners switch allegiances among BTC, ETH, and altcoins—juggling hash potential against market capitalization to optimize ROI dynamically.

A striking example emerged in mid-2024 when a mining collective pivoted from ETH to DOG mining at the cusp of a network upgrade boosting DOG’s hashrate efficiency. Result? A short-term spike in profitability exceeding 35%, underscoring the value of algorithmic agility and real-time market data analysis.

Risk Management: Weathering Regulatory and Market Volatility

Forecasting mining profits requires more than crunching math; it demands an eye on geopolitical tremors, energy policy shifts, and crypto regulations. The 2025 report from the International Cryptocurrency Regulators Panel (ICRP) highlights that sudden energy curtailments or stiffer emissions standards in key mining hubs have slashed potential earnings by up to 15% in under six months, showcasing the fragility of mining farm projects without dynamic contingency planning.

Miners who diversify geographically and invest in modular mining rigs capable of fast redeployment gain a tactical advantage. This flexibility translates to resilience, ensuring profitability thresholds are met even when storms (literal and figurative) hit hard.

Putting It All Together: The Mining Profitability Crystal Ball

To maximize investment returns, adopting a multi-layered approach—integrating real-time analytics with strategic fleet management and agile market positioning—is essential. Cutting-edge platforms now offer AI-enhanced forecasting tools, analyzing everything from electricity rate forecasts to blockchain difficulty curves, helping miners *anticipate* profit bottlenecks before they hit.

Case in point: a mining rig operator using such a platform predicted a Bitcoin difficulty surge and preemptively reallocated resources to DOG mining temporarily. The maneuver preserved margins and mitigated downtime losses—showing that tech-savvy miners are winning the race by *playing the future, not just the present.*

Mining profitability isn’t a fixed number—it’s a living equation shaped by hardware, energy markets, chain protocols, and global regulations. Smart investors who blend data intelligence, operational flexibility, and strategic timing will not just survive but thrive in this hyper-competitive arena.

Author Introduction

Andreas M. Grant is a distinguished blockchain analyst and author with over 15 years in cryptocurrency research and mining technologies.

Certified Blockchain Expert (CBE) and former lead strategist at CryptoData Insights.

Renowned for contributions to the *Journal of Digital Finance* and keynote speaker at the 2024 Global Crypto Mining Summit.

The low latency in the Netherlands really helps my Bitcoin mining profitability, highly recommended!

If you’re curious, Bitcoin’s value in 2003 was zero—flat out—as the coin launched six years later, making early adopters look like geniuses with their hodl strategies.

I personally recommend stacking sats early since the release timeline means scarcity only increases with time.

To be honest, Bitcoin’s price surge back in 2017 totally changed my investment game.

To be honest, after learning to calculate Bitcoin rise multiples, I started using it as a benchmark to compare other altcoins’ performance. Very handy metric!

Honestly, the Canaan A1246 I sourced from Holland surprised me with its energy efficiency. You may not expect such performance from a mid-range model, but it’s outperforming my older units.

I personally recommend this tool because Bitcoin subtraction and addition are seamless and clear.

Graphs for Bitcoin stocks are clean, detailed, and help me analyze market sentiment quickly.

Canadian Bitcoin mining rig is humming along nicely. Here’s hoping for a bull run by 2025!

If you’re new to Bitcoin mining, slushpool’s guide on how to start mining Bitcoin is a lifesaver. The step-by-step process and transparent fees helped me avoid rookie mistakes. You may not expect such detailed support from a mining pool in this competitive space.

I dove into Canadian mining hardware investments last year, and honestly, the ASIC rigs from Bitmain are top-notch for crypto returns.

The power demand for setting up a bitcoin mining farm is insane; you’ll need to collaborate with your local utility company to negotiate industrial rates that won’t kill your profit margins fast.

I personally recommend checking resale values when comparing miner prices; future liquidity is a crucial consideration.

I personally recommend Bitcoin mining only if you’re tech-savvy and patient, because despite the rewards, the 2025 dangers like market manipulation and energy shortages can lead to major setbacks.

y, real talk, this Texas farm with $0.04/kWh power is a game-changer; my hash rate’s soaring and my ROI is looking fire!

This 2025 mining machine hosting download is packed with pro tips on rig maintenance and fees—total game-changer for newcomers.

I personally recommend understanding Bitcoin’s “Big Block” term because it highlights the push for faster confirmation times and higher transaction throughput, very crucial for anyone into digital coins.

I personally recommend avoiding small, unknown exchanges for Bitcoin to USD conversions; big players like Gemini or Coinbase have better security and faster withdrawals.

Frankly, navigating the global supply chain for GPUs in 2025 is still a headache; lead times are insane.

Minimal Bitcoin buying limits made my crypto journey less scary and more manageable, especially as I learned to watch market trends and price shifts closely.

I recommend Huobi for anyone serious about Bitcoin deposits—it’s got solid blockchain verification times, transparent wallet balance updates, and the recharge process is smooth, making trading bumps a thing of the past.

I personally recommend diving deep into this power requirement guide; it’s saved me from some serious overspending on wattage.

My new mining rig for altcoins is a game-changer, with high throughput and easy maintenance routines.

Crypto mining hosting for 2025 is all about proactive recommendations, solving common issues like connectivity drops through advanced network redundancy features.

You may not expect RP to influence Bitcoin’s market moves.

cost of electricity is going to be the key driver of success for Bitcoin miners in 2025.

Top reviews highlight Aussie gear for its user-friendly investment interfaces.

Small Bitcoin mining farms usually require solid internet and cooling systems.

You may not expect how seamless the trading interface is here; the site loads fast, and support is instantly helpful when you’re stuck.

This Ethereum mining rig runs super cool, even under heavy load. I’m impressed with the thermal management system.

To be honest, I used to overlook the importance of my Bitcoin position, but learning this concept made me more disciplined about my risk, especially when the price swings aggressively within minutes.

I personally recommend setting up price alerts on your exchange of choice to catch those sweet dips when buying Bitcoin; it helps you time the market.

I’m telling you, Bitcoin nearing $70k is huge news; even casual investors are starting to understand the potential upside here.

“2025’s crypto profitability tool revealed I was mining the wrong coin. Smart move.”

I’m looking for feedback from 2025 wind power mining farm owners. Are the initial costs manageable?

I personally recommend this route because Monero’s network upgrades promise even better returns for Australian mining enthusiasts.

To be honest, Phemex’s BTC market overviews are fairly reliable with clean visuals and no confusing bells or whistles, giving users legit info without the hype.

You may not expect it, but some platforms hold your BTC withdrawal for days! I found Kraken to be pretty smooth with their withdrawal process, which saved me a lot of time and headaches.